Victor Garcia and Kaysea Suzana | PantherNOW Staff

In the midst of a Miamian housing crisis, banking company Wells Fargo came to FIU’s College of Business to curate a homeownership fair for FIU students, staff and faculty.

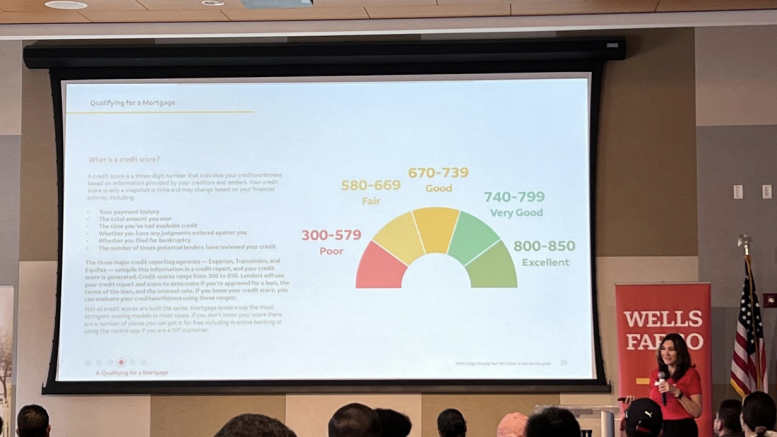

Hosted at the College of Business Complex on May 6, the fair included a three-hour lecture on the basics of down payments, closing costs and factors that determine your credit score.

Market manager Angel Buchanan began the event by introducing the crowd to a presentation where she gave an overview of the topics to be covered, ranging from credit issues and solutions to mortgage loaning.

Alongside the main presentation, various other institutions such as United Way, Public Housing and Community Development, Real Estate Education and Community Housing and the Neighborhood Housing Services of South Florida had their own informational table in the room.

Ruthy Charles, financial coach for United Way, mentions the support and programs provided to college students.

“There is a center of financial help that aids students in making a plan to help them achieve financial goals. We don’t offer advice, we make you a plan that shows you what you need to reach your desired numbers,” said Charles.

Attendees of the event were also given a selection of free breakfast items such as fruit, baked pastries, coffee and tea.

Bob Badgley, home loaning manager of the fair, continued the main presentations, clarifying the various Federal Housing Administration loans that are available to more than just first time buyers.

He also highlighted underused financial tactics such as amortization, which is to pay a debt off in time with equal amount installments, or the requirements of an Escrow account for homeowners and buyers.

The speakers held an audience Q&A at the end of the event, with some asking about the impacts of two lenders on a loan, or the applicability of 401k on a down payment.

“If there are two lenders on one loan, we take the lower credit. There is no rounding out of the price or credit. We base off our prices always off the lower credit score,” Badgley explained.

Mortgage bank sales consultant Solomon Consuegra clarified that a 401k plan can only be used for down payments if it’s not adjudicated as a loan to the payer, and that student loans or any kind of debt negatively affects your credit score and your banking opportunities.

Maria Servitad, mortgage bank sales consultant and loan originator, commented on detrimental pitfalls for students regarding credit.

“The worst mistake to make is increasing your expenditure when you begin to earn a higher income. Avoid interest rates, and prove you’re responsible with your credit. First, become financially stable. Budgeting is crucial to staying on top of your debts,” Servitad said.

FIU graduate attendee Samantha Lamosa commented on the importance of financial literacy.

“Many are not informed about finance. Even this event has its barriers, whether it be language difficulties or even showing up when some simply don’t have the time or transportation.”

Lamosa commented on logistical issues her family faces when it comes to learning about finances and homeownership.

“I originally came here to learn for both myself, and for my mother who could not attend as she is working. While here, I realize that this information is crucial for people to know. It’s a lot easier to get a basic understanding of financial matters when there are events like these,” Lamosa said.

Be the first to comment on "“How To Buy A House”: Wells Fargo hosts financial literacy fair at the College of Business"