Jasiel Lopez/Staff Writer

College students in the U.S. pay an average of $9,410 every year on in-state tuition when enrolled in a public university, according to the College Board. Current and former students owe an average of $32,731 in student loan debt, according to a 2016 report by the Federal Reserve.

Higher education can be costly, but college students with tight budgets can find relief in the form of deductions on interest loans and refundable tax credits when filing their tax returns.

Despite changes to the tax code with the passage of the Tax Cut and Jobs Act, passed in late Dec. 2017, the major provisions for students will remain.

“There are three different [tax provisions], the American Opportunities Tax Act credit, The Lifetime Learning credit and interest on student loans deductions. None of that changed under the new law,” said Tessie Brunken, a clinical instructor in the School of Accounting at FIU.

The American Opportunities Act Tax Credit awards up to $2,500 to eligible students, with 40 percent ($1,000) being refundable. However, the AOATC cannot be claimed for more than four tax years, according to irs.gov.

Another tax credit, the Lifetime Learning Credit, which has no limit on the number of years it can be claimed, awards 20 percent of tuition and fees. The LLC, however, is capped at $2,000 per tax year and no portion of it is refundable.

To claim the aforementioned tax credits, students should acquire their 1098-T form, provided by their university. The 1098-T form can be used by tax preparers to calculate the credits for which a student qualifies and how much of each can be claimed. FIU students can find their 1098-T form under the campus finance tab at my.fiu.edu. Students can also contact Student Financials Office for any questions regarding their 1098-T form at (305) 348-2126.

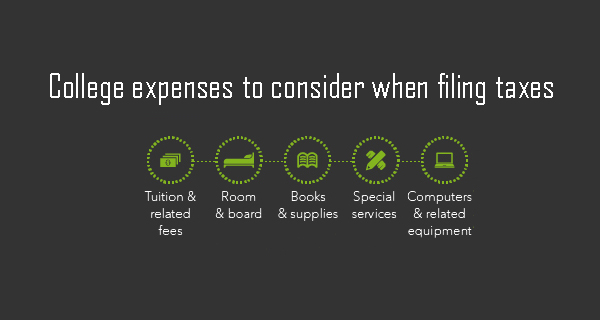

College students should look beyond what is in their 1098-T form when filing taxes.

“In order to calculate the tax credit, you can claim money spent on books, supplies, equipment, food and dormitory fees. Many of those costs are out of pocket and don’t show up on the 1098-T form.” said David Lavin, a retired professor from FIU’s School of Accounting, and director of his own accounting firm.

Interest paid on student loans is also deductible, allowing as a reduction in taxable income of up to $2,500 per tax year.

Although it may be daunting for many, students do not have to navigate the complexity of the tax code alone.

“One of the biggest things I tell students is that there are services available to them that are free to file their taxes through the IRS. It’s called the Volunteer Income Tax Assistance program (VITA). For people with income under certain amount, that [tax] preparation is done for them for free,” said Brunken.

When meeting with tax preparers, Lavin recommends that those filing taxes should look for any expenses that differ from previous tax years.

“You should be knowledgeable about what to save and what not to save. Take note of any unusual things for that year, such as a purchase of car or house,” said Lavin.

The last day to file personal income taxes for the 2017 tax year is April 17, 2018.

*DISCLAIMER* This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors.

Feature Image by Jasiel Lopez/PantherNOW

Be the first to comment on "Professors discuss tax deductions for students"